BTC Dips to $100 After Fed Rate Cut, and Kraken Launches Ink - December 19, 2024

Also, WLF partners with Ethena, and Grayscale’s BTC Mini Trust sees $1B inflows.

TL;DR: Crypto Insights in Seconds

BTC: Dips after Fed rate cut but analyst expect a potential rally.

Stablecoins: MiCA-complaint stablecoins grow in volume.

Coinbase: Judge rejected BiT Global's plea to stop Coinbase from delisting wBTC.

Kraken: Launches Ink, a Layer 2 blockchain.

WLF: Partnership with Ethena to improve financial services.

Grayscale: BTC Mini Trust sees $1 billion inflows.

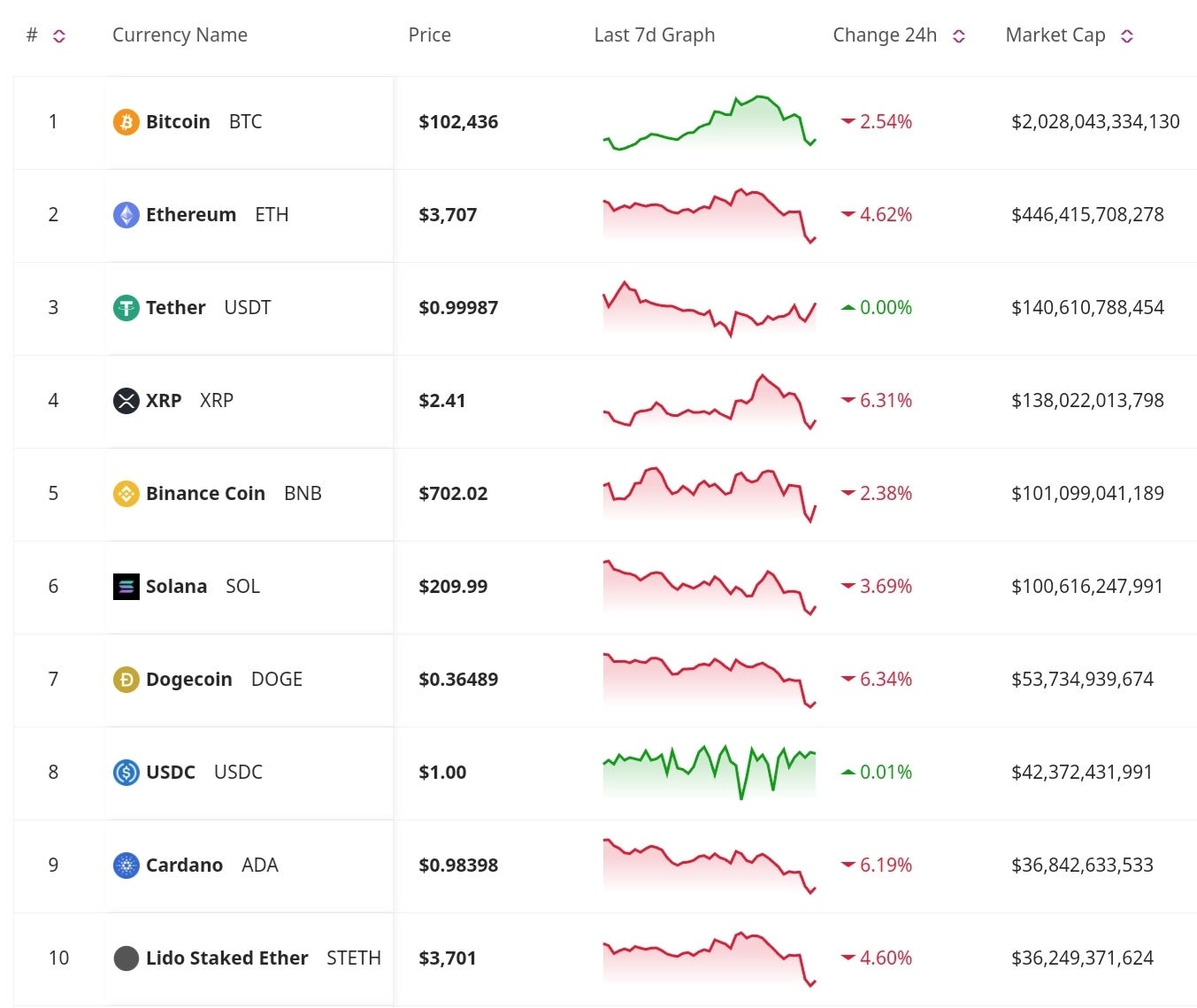

Price Update

Fed Rate Cut and Bitcoin’s Dip to $100.3K

The Federal Reserve announced a 25-basis-point rate cut, lowering the federal funds rate to 4.5%. Federal Reserve Chair Jerome Powell also revised the 2025 inflation outlook higher, adding pressure on risk assets, including Bitcoin. Following the announcement, Bitcoin retraced to $100.3K, marking a brief pullback after its recent rallies. Analysts note that profit-taking is declining, signaling potential room for a fresh rally.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

MiCA-Compliant Stablecoins Grow

In Europe, MiCA-compliant stablecoins now dominate local markets, according to a report from Kaiko. The research firm confirms that the trading volume for 2024 consistently exceeded 2023 volume, making the euro the third most traded fiat currency.

Regulatory and Legal News

Federal Judge Denies BiT Global’s Request to Halt Coinbase’s wBTC Delisting

A federal judge rejected BiT Global's plea to stop Coinbase from delisting Wrapped Bitcoin (wBTC). Coinbase argued its decision was due to risks linked to Justin Sun’s involvement, citing prior regulatory issues. BiT Global accused Coinbase of using Sun as a pretext, claiming financial harm for wBTC holders. While the judge denied the temporary restraining order, BiT Global may continue its legal challenge.

Don’t Miss Anything

Kraken Launches Ink, a Layer 2 Blockchain, Months Ahead of Schedule

Kraken has introduced Ink, its Ethereum Layer 2 blockchain, built using Optimism’s Superchain technology. Initially planned for 2025, the mainnet launch came early and features interoperability with other OP Stack-based networks. Partners like Curve, Frax, Gelato, and LayerZero are part of the launch.

Trump’s World Liberty Financial Partners with Ethena Labs

Ethena Labs announced a strategic partnership with Trump-backed World Liberty Financial. The collaboration will focus on promoting blockchain-based financial services, demonstrating the growing institutional interest in the space.

Grayscale’s Bitcoin Mini Trust Sees $1B Inflows

The Grayscale Bitcoin Mini Trust, structured as a mini ETF, has crossed $1 billion in net inflows. This milestone reflects the strong demand for diversified Bitcoin investment vehicles amidst ETF optimism.

The crypto ecosystem remains dynamic, responding to macroeconomic shifts like Fed rate adjustments and new financial innovations. With strong ETF inflows and regulatory compliance paving the way for further institutional adoption, market participants remain cautiously optimistic despite near-term volatility. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

impressive ❤️