Bitcoin's Drop to $91K Leads to the Biggest Liquidation in Crypto History - February 4, 2025

Also, Kraken and Coinbase expand to EU and UK, and Cboe 24-hour stock trading.

TL;DR: Crypto Insights in Seconds

BTC: Has a major drop after Trump’s tariffs threats that affected the overall global market.

Crypto: Monday sees the biggest liquidation in crypto history according to analysts.

Funds: Inflows drop drastically due to market uncertainty.

U.S.: Trump signed an executive order to create a wealth fund that could include BTC.

Exchanges: Kraken and Coinbase secure regulatory approvals to expand to the EU and UK.

Cboe: Will launch a 24-hour stock trading market.

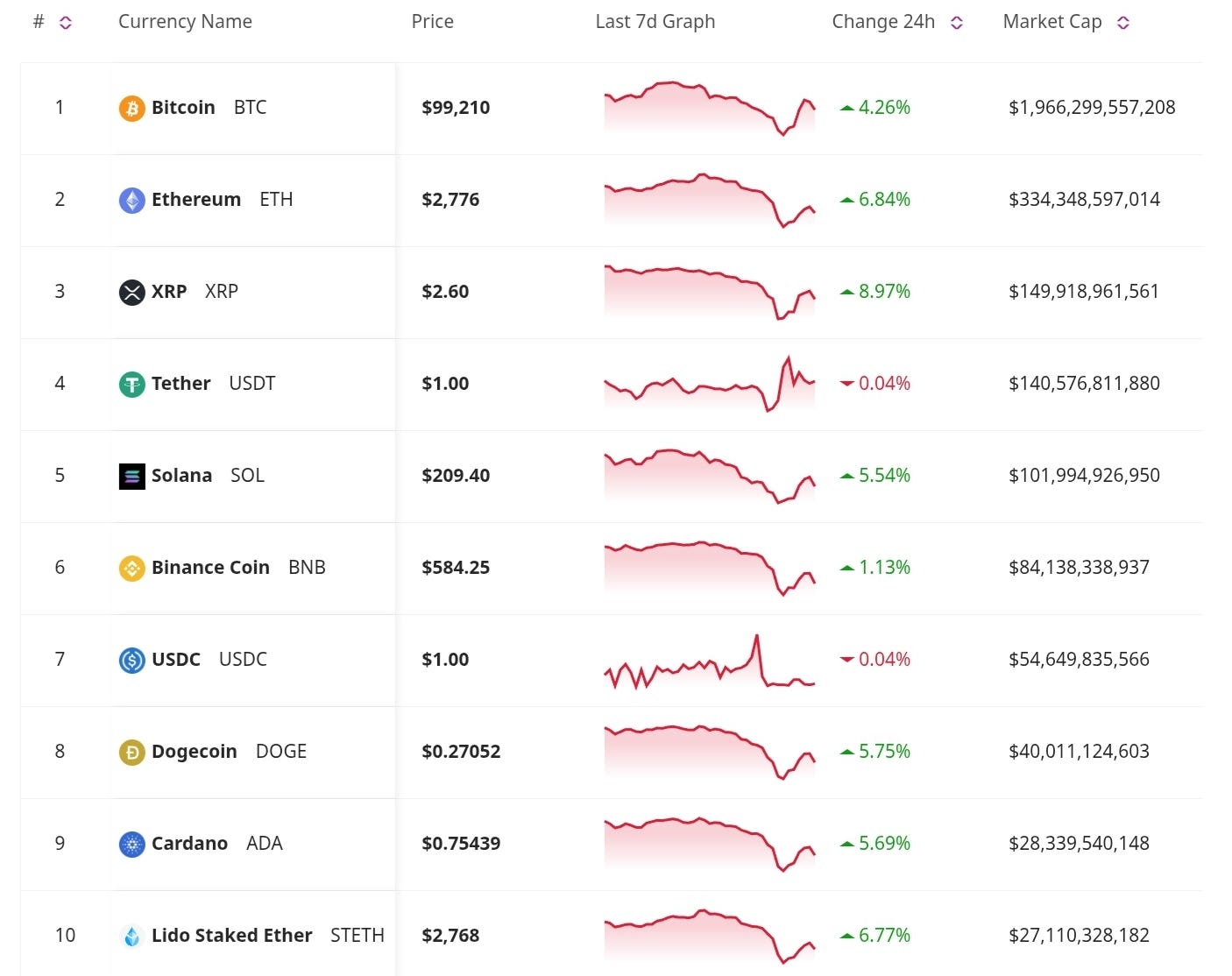

Price Update

BTC Falls to $91K After Trump’s Tariffs Threats

President Trump announced steep tariffs on imports from Canada, Mexico, and China, sparking a sell-off in crypto markets. Bitcoin slipped below $100,000, and analysts predict it could keep dropping. Memecoins saw sharp declines too, with Trump’s own memecoin dropping 30% over the week, causing billions in liquidations.

Financial analyst Jeff Park from BitWise predicts that President Trump’s tariffs will drive Bitcoin prices significantly higher over time. As inflation rises, U.S. trading partners will face currency debasement, prompting global investors to seek alternative stores of value like Bitcoin.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

The Biggest Daily Liquidation In Crypto History

The market's extreme turbulence has led to over $2.38 billion in liquidations—though Bybit CEO Ben Zhou estimates the real figure could be as high as $10 billion. The number is bigger than past events, like COVID-19 or the FTX collapse. Despite the downturn, financial experts like Robert Kiyosaki see this as a buying opportunity, urging investors to stay calm amid broader market corrections across stocks, bonds, and commodities.

Crypto Fund Inflows Drop Amid Market Uncertainty

Global crypto funds saw a sharp drop in inflows last week, registering $527 million—down 72% from the previous week's $1.9 billion—due to concerns over Trump’s proposed trade tariffs and DeepSeek-related market turbulence. Analysts note that despite the sell-off, 2024 has seen $44 billion in inflows, indicating sustained investor interest.

New Developments

U.S. Wealth Fund Could Include BTC

President Donald Trump signed an executive order to create a U.S. sovereign wealth fund. While specific investments weren't outlined, Bitcoin advocates see potential for crypto inclusion. Wyoming Senator Cynthia Lummis suggested Bitcoin could be part of the fund. Following the announcement, Bitcoin rebounded above $101,000 after dipping below $100,000 due to recent tariff concerns.

Kraken and Coinbase Expand to EU and UK market

Kraken and Coinbase have secured key regulatory approvals to expand in Europe and the UK. Kraken obtained an Electronic Money Institution (EMI) license allowing it to offer pound- and euro-denominated payment services. Meanwhile, Coinbase received a registration from France’s financial regulator, AMF, enabling it to operate fully under the EU’s new MiCA framework.

Cboe Will Launch 24h Stock Trading

Cboe Global Markets, a major derivatives and securities exchange, has announced plans to implement 24-hour weekday trading, starting on Feb. 3. The move is aimed at addressing growing global demand for U.S. equities trading, particularly from markets in Asia Pacific.

The market sees a turbulent weekend and Monday with major liquidations that some analysts claim as the biggest in crypto history. Even though some traders suggest caution for a potential second drop, others recommend ‘buying the dip’ and playing the long-term game. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.