Bitcoin Reaches $60K, XRP Surges, and Solana-Based ETF Approved in Brazil - August 9, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: Approaches $60K as the crypto market bounce accelerates.

XRP: Jumps 17%, outperforming Bitcoin as Ripple’s SEC case concludes.

Brazil’s SEC: Approves Solana-based ETF.

Crypto ETFs: Bitcoin ETF sees $45 million in inflows, while Ether ETF experiences $23 million in outflows.

Binance: Launches TONcoin spot trading.

JPMorgan: Reports increasing Bitcoin interest from institutional investors.

WazirX: To undo all trades following a $230 million hack-related withdrawal freeze.

FTX: The Exchange and CFTC reach a settlement, approved by the court.

Terraform Labs Case: Montenegrin court postpones Do Kwon's extradition to South Korea again.

U.S. Regulations: Crypto executives meet with White House officials to discuss policy concerns.

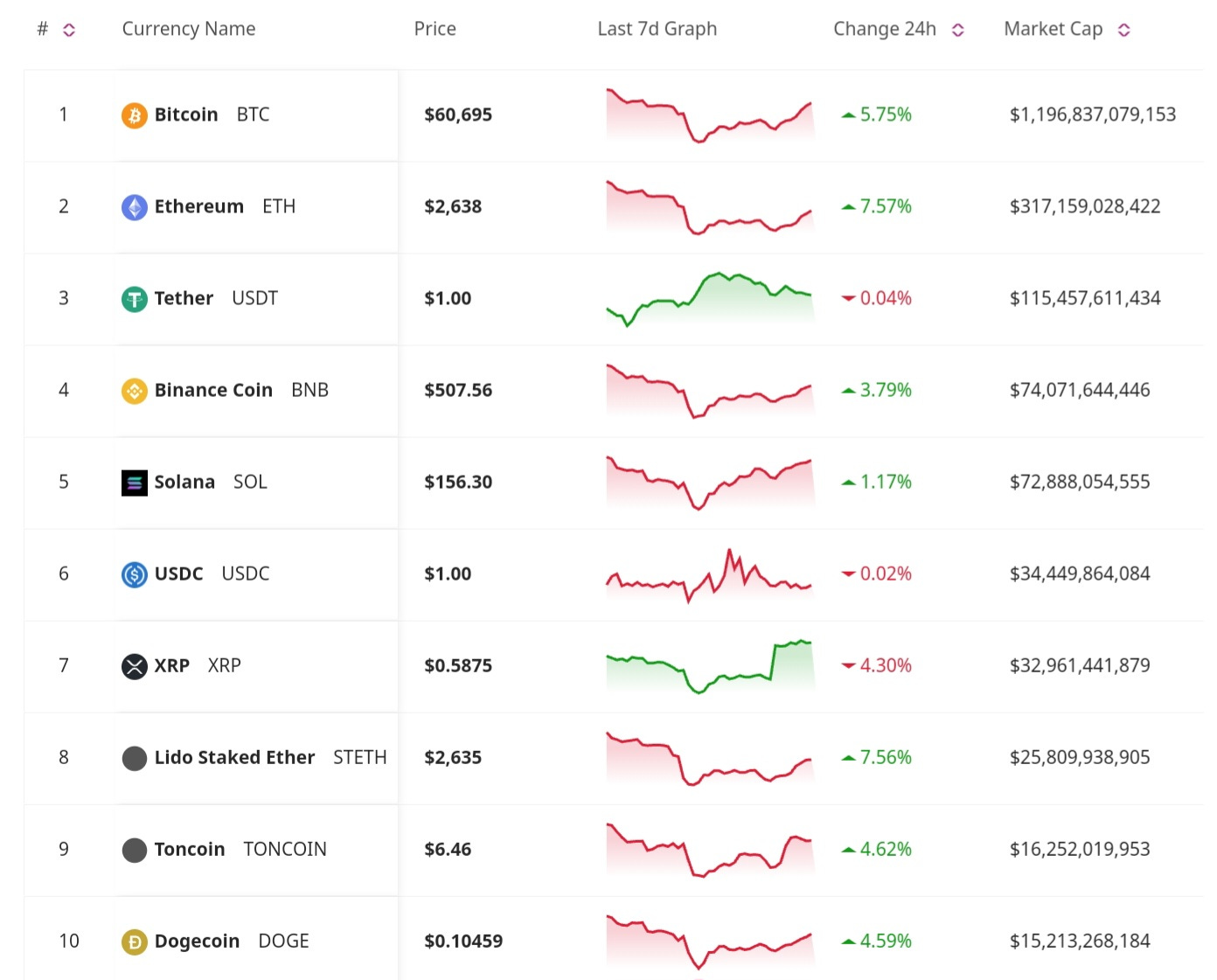

Price Update

Bitcoin Reaches $60K as Market Bounce Accelerates

Bitcoin is closing in on the $60,000 mark as the crypto market continues its recovery. However, analysts warn that the recovery could be choppy, with potential volatility ahead. This rebound reflects renewed investor confidence and the easing of recent market fears, despite uncertainties in the industry and macroeconomic indicators.

XRP Jumps 17% as Ripple’s SEC Case Ends

XRP has surged by 17%, outperforming Bitcoin and other major cryptocurrencies, following the conclusion of Ripple’s legal battle with the SEC. The end of the case has removed a significant cloud of uncertainty hanging over XRP, leading to increased buying activity. Ripple’s victory in court could also set a precedent for other crypto-related legal cases in the future.

Crypto ETFs News

Bitcoin ETF Sees $45M Inflows While Ether ETF Faces Outflows

Bitcoin ETFs have recorded $45 million in inflows, showing continued investor confidence in the leading cryptocurrency. In contrast, Ether ETFs experienced $23 million in outflows, reflecting a more cautious sentiment towards Ethereum. While Bitcoin remains a favored asset for institutional investors, Ethereum’s recent price movements and market conditions have led to some profit-taking and repositioning.

Brazil Approves Solana-Based ETF

Brazil’s Securities and Exchange Commission has approved the country’s first Solana-based ETF. This marks a significant milestone for Solana and its growing influence in the global crypto market. The approval showcases Brazil’s openness to innovative financial products and its leadership in Latin America’s crypto sector. The Solana-based ETF provides Brazilian investors with regulated access to the rapidly growing Solana ecosystem.

Regulatory and Political News

FTX and CFTC Settlement Approved by Court

The court has approved a settlement between FTX and the Commodity Futures Trading Commission (CFTC), bringing an end to the regulatory dispute. The settlement resolves allegations related to FTX’s trading practices, with the exchange agreeing to pay fines and implement compliance measures. This resolution is seen as a positive development for FTX, allowing it to move forward without the overhang of regulatory uncertainty.

Crypto Executives Meet White House Officials to Discuss Policy

Crypto executives recently held a virtual roundtable with White House officials to discuss policy grievances and the future of crypto regulation. The meeting provided a platform for industry leaders to express concerns over the current regulatory landscape and propose potential improvements. Topics likely included the need for clear guidelines, the impact of recent regulatory actions, and the role of the U.S. in fostering crypto innovation. The outcome of this meeting could influence future regulatory approaches and the relationship between the crypto industry and the government.

Montenegrin Court Postpones Do Kwon’s Extradition Again

A Montenegrin court has once again postponed the extradition of Do Kwon to South Korea. Kwon, the founder of Terraform Labs, faces charges related to the collapse of the TerraUSD stablecoin. The repeated delays in the extradition process have drawn international attention, with legal complexities and diplomatic considerations playing a role.

Launches and Developments

Binance Launches TONcoin Spot Trading

Binance has launched spot trading for TONcoin, expanding its offerings and providing users with access to the native token of The Open Network (TON). The addition of TONcoin spot trading is expected to increase liquidity and trading activity for the token, which has been gaining attention for its use in dApps and smart contracts.

Franklin Templeton Expands Blockchain Fund to Arbitrum

Franklin Templeton’s blockchain money market fund, known as FOBXX, has expanded to Arbitrum, a popular Ethereum Layer-2 solution. This expansion allows the fund to take advantage of Arbitrum’s scalability and efficiency, providing investors with faster and cheaper transactions. The expansion to Arbitrum is expected to attract more investors seeking exposure to blockchain-based financial instruments.

Don’t Miss Anything

JPMorgan: Institutional Interest in Bitcoin Rebounds

JPMorgan has reported a rebound in institutional interest in Bitcoin, following the cryptocurrency’s recent price recovery. The bank noted that institutional investors are increasingly viewing Bitcoin as a strategic asset while navigating economic uncertainties. This renewed interest is seen as a positive sign for the broader market, indicating that Bitcoin continues to gain acceptance among traditional financial institutions.

WazirX to Undo All Trades After $230M Hack

WazirX, an Indian crypto exchange, has announced plans to undo all trades following a $230 million hack-related withdrawal freeze. The decision to reverse trades is part of the exchange’s efforts to mitigate the impact of the hack and restore user trust. The hack has raised significant concerns about security practices in the crypto industry and the need for robust protection measures.

The cryptocurrency market is witnessing significant developments as Bitcoin approaches $60K and XRP surges following the resolution of Ripple’s SEC case. Institutional interest in Bitcoin is rebounding, as evidenced by ETF inflows and JPMorgan’s observations. Regulatory actions, such as the approval of Brazil’s Solana-based ETF and FTX’s settlement with the CFTC, continue to shape the market landscape. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc