Bitcoin Jumps Back, Aave's Revenue, and Trump on U.S. Crypto Holdings - August 6, 2024

A quick and digestible recap of yesterday’s crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: jumps back to $55K after a brutal sell-off.

Aave: Generates $6 million in revenue despite the crypto market plunge.

Trump: States the U.S. government shouldn't sell its cryptocurrency holdings.

Ethereum: Transaction count hits a five-month low as Layer-2 solutions surge.

Capula: Hedge fund giant reports owning $464 million in spot Bitcoin ETF shares.

U.S.: Experts urge the Fed for an emergency interest rate cut.

Crypto Equities: Face significant pre-market drops.

Crypto Cap: The crypto market cap experiences the largest drop this year.

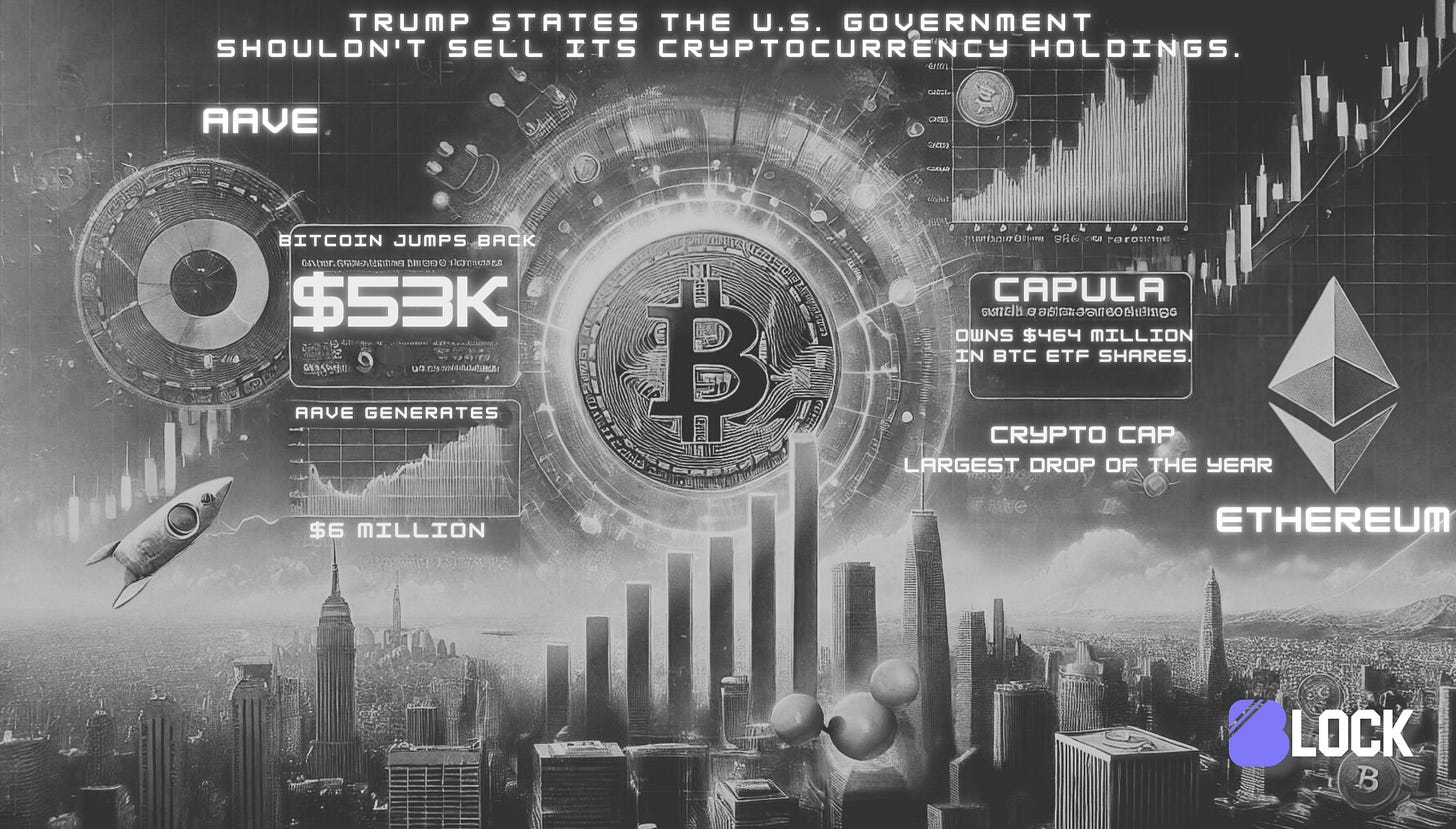

Price Update

Bitcoin Rebounds to $55K After Brutal Sell-Off

Bitcoin has bounced back to $55,000 following a severe sell-off that evoked memories of the COVID crash. This rebound indicates strong support levels and investor confidence despite recent market turbulence. Macroeconomic factors and market sentiment drove the sell-off, especially the fears about a possible recession.

Market Trends and Expectations

Bitcoin Dominance Surges to 60%

Bitcoin's market dominance has risen to 60% during the overall crypto market downturn. This increase in dominance suggests that investors seek refuge in Bitcoin, perceived as a safer asset than other cryptocurrencies. Bitcoin's strong dominance may continue to influence market dynamics in the near term.

Crypto Market Cap Experiences Largest Drop This Year

The overall crypto market cap has seen its largest drop this year, reflecting widespread declines across various cryptocurrencies. This significant reduction in market cap is attributed to heightened economic uncertainty and negative investor sentiment. The drop has affected nearly all major cryptocurrencies, contributing to increased volatility and caution among traders.

Crypto Equities Face Pre-Market Drops

Crypto equities have experienced significant pre-market drops, reflecting wider market trends and investor caution. Companies with strong ties to the crypto industry are seeing their stock prices affected by the recent downturn in cryptocurrency prices. This correlation highlights the interconnectedness of traditional financial markets and the crypto sector.

Ethereum Transaction Count Hits Five-Month Low

Ethereum's transaction count has reached a five-month low, coinciding with a rise in Layer-2 solutions. These solutions are gaining traction as they offer faster and cheaper transactions compared to the Ethereum mainnet. The decline in transaction count on Ethereum suggests a shift towards these more efficient alternatives. The growth of Layer-2 solutions is a positive development for the Ethereum ecosystem, improving its overall functionality.

U.S. Developments

Experts Call on the Fed for Emergency Interest Rate Cut

Financial experts are calling on the Federal Reserve to implement an emergency interest rate cut to stabilize the economy. This call comes during increasing economic uncertainty and market volatility. An emergency rate cut could provide much-needed relief to financial markets and support economic growth. The response from the Fed will be crucial in shaping the economic landscape in the coming months.

Donald Trump Says U.S. Shouldn't Sell Its Cryptocurrency

In a recent statement, Donald Trump asserted that the U.S. government should not sell its cryptocurrency holdings. Trump's comments come during ongoing debates about the role of digital assets in national financial strategies. His stance highlights the growing recognition of cryptocurrencies as valuable assets that could play a strategic role in the future.

Don’t Miss Anything

Aave Generates $6M in Revenue Amid Market Plunge

Despite the crypto market's downturn, DeFi giant Aave has reported $6 million in revenue. This impressive performance highlights the strength of DeFi platforms in generating income even during market declines. Investors are viewing Aave and similar platforms as critical components of the crypto ecosystem, capable of weathering market volatility.

Hedge Fund Giant Capula Reports Significant Bitcoin Holdings

Capula, a major hedge fund, has reported owning $464 million in spot Bitcoin ETF shares. This substantial investment reflects the continued interest and confidence of institutional investors in Bitcoin. The disclosure of such significant holdings is likely to inspire confidence among other institutional investors and further validate Bitcoin's role in diversified investment portfolios.

The cryptocurrency market is experiencing significant fluctuations, with Bitcoin's recent rebound and dominance surge reflecting its resilience. Despite market downturns, platforms like Aave demonstrate the robustness of DeFi, while institutional interest remains strong, as seen with Capula's substantial Bitcoin holdings. Global economic factors, including calls for an emergency Fed rate cut and rising recession fears, continue to influence market sentiment. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc