Bitcoin Holds Strong at $95K, Ethereum ETFs Heat Up, and Key Regulatory Shifts Rock Crypto

Whale Moves, Ethereum ETFs, and Bitcoin’s Resistance Test

TL;DR: Key Crypto Insights in Seconds

Bitcoin Maintains Stability: Whale accumulation strengthens support despite institutional sell-offs and ETF uncertainties. Over 110,000 traders liquidated during volatile price movements.

Ethereum ETF Advances: SEC opens public feedback on Ethereum ETF options, potentially boosting institutional engagement with Ethereum.

$8.1B Lawsuit Against Binance: Nigeria sues Binance over tax evasion claims, highlighting growing regulatory pressure on centralized exchanges.

Milei’s Pro-Crypto Stance: Argentina's leader denies Libra endorsement but stresses focus on established digital assets like Bitcoin.

Trump’s Crypto Vision: U.S. President aims to position the U.S. as a leader in digital innovation, calling for regulatory shifts.

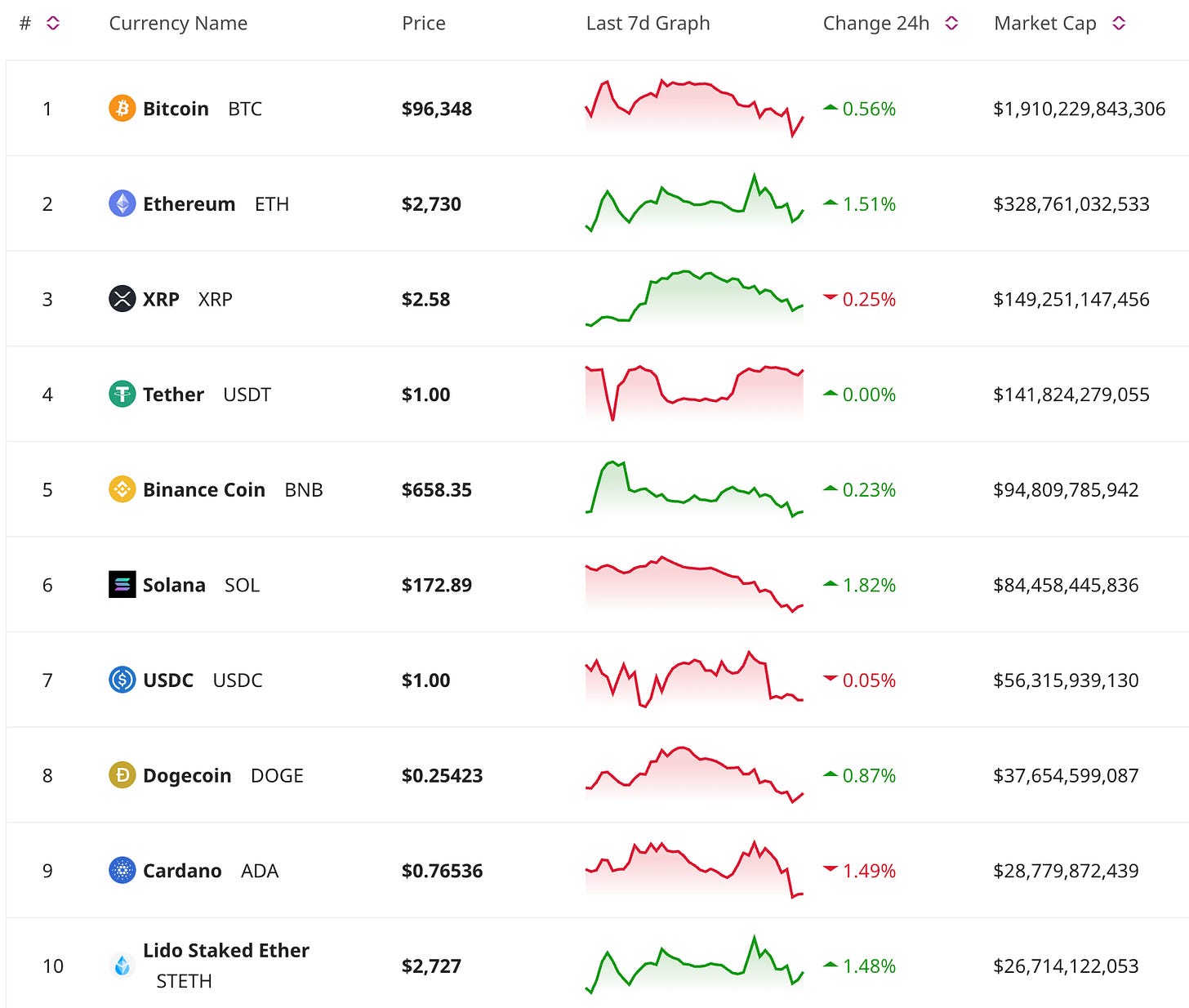

Price Update

Bitcoin Market Analysis: Stability Amid Challenges

Bitcoin remains stable despite conflicting market forces. Whale accumulation is tightening supply, bolstering long-term confidence, while steady retail interest adds further support. However, institutional sell-offs reflect caution tied to ETF approval delays and macroeconomic concerns.

Recent volatility has also left a mark, with over 110,000 traders liquidated in just 24 hours, exposing the risks of leveraged positions. This unpredictable environment acts as both a challenge and a reminder for traders to approach strategies prudently. Despite these mixed signals, Bitcoin’s enduring resilience highlights its role as the leading digital asset.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Regulatory & Legal News

Ethereum ETF Options Trading Gains Traction

The SEC is inviting public feedback for the potential approval of Ethereum ETF options trading, marking a significant step for the Ethereum ecosystem. Major players such as Grayscale and Bitwise are advocating for these products, which could unlock greater flexibility for institutional investors.

This development signals optimism for Ethereum’s growing presence in traditional finance. Should these ETFs gain approval, they may usher in expanded adoption and higher engagement with the Ethereum network, reinforcing its role beyond just smart contracts and DeFi.

Nigeria Files $8.1B Lawsuit Against Binance

Nigeria has taken legal action against Binance, accusing the exchange of tax evasion and causing economic harm. This unprecedented $8.1 billion lawsuit underscores the rising scrutiny centralized exchanges face, especially in regions with evolving regulatory frameworks.

The outcome of this case could have far-reaching implications for exchanges operating in similar markets. Investors and crypto companies alike must remain alert to how this legal battle unfolds and its potential to reshape compliance standards on a global scale.

Don’t Miss Anything

Milei Denies Libra Token Endorsement

Argentina’s president, Javier Milei, dismissed rumors that he endorsed the Libra token. While maintaining his pro-crypto stance, Milei clarified his skepticism toward speculative projects like Libra, underscoring his administration's focus on established digital assets like Bitcoin.

This statement signals that while there is enthusiasm for crypto innovation, aligning with unproven technologies or tokens may not align with the agenda of leaders seeking long-term economic credibility tied to blockchain’s potential.

Trump Looks to Position the U.S. as a Crypto Leader

President Donald Trump has declared his intention to prioritize crypto innovation should he return to office. With ambitions of positioning the United States as a global leader in digital assets, Trump’s comments emerge amid increasing regulatory challenges for crypto businesses within the U.S.

While the vision is bold, achieving this goal would require significant shifts in regulation. Bridging bipartisan gaps and addressing concerns over security and fraud will likely be pivotal in fostering a crypto-friendly ecosystem at the national level.

The crypto market is full of surprises, and staying informed is your best edge. From groundbreaking innovations to unexpected shifts, there’s always something new to explore. Remember, knowledge is power—staying ahead starts with staying curious. We’ll catch you next time with more stories, insights, and tools to guide your crypto adventures. Until then, don’t hesitate to share this newsletter with fellow enthusiasts and keep the conversation going!