Bitcoin Hits $62K, Ripple Tests Stablecoin, and IRS Updates Crypto Tax Forms - August 12, 2024

A quick and digestible recap of the weekend's crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: Spikes over $62K and bulls revisit a $100K year-end target.

Hong Kong: Crypto ETF system faces systemic market obstacles.

Crypto.com and Gemini: Join Coinbase in opposing a CFTC proposal that could ban prediction markets.

IRS: Updates crypto brokerage tax forms, appears to remove the request for wallet addresses.

SEC: Postpones decision on Hashdex’s proposed ETF to hold Bitcoin and Ether.

Ripple: Begins testing its stablecoin, RLUSD, on the XRP Ledger and Ethereum.

U.S. spot Bitcoin ETFs: See $192 million in inflows.

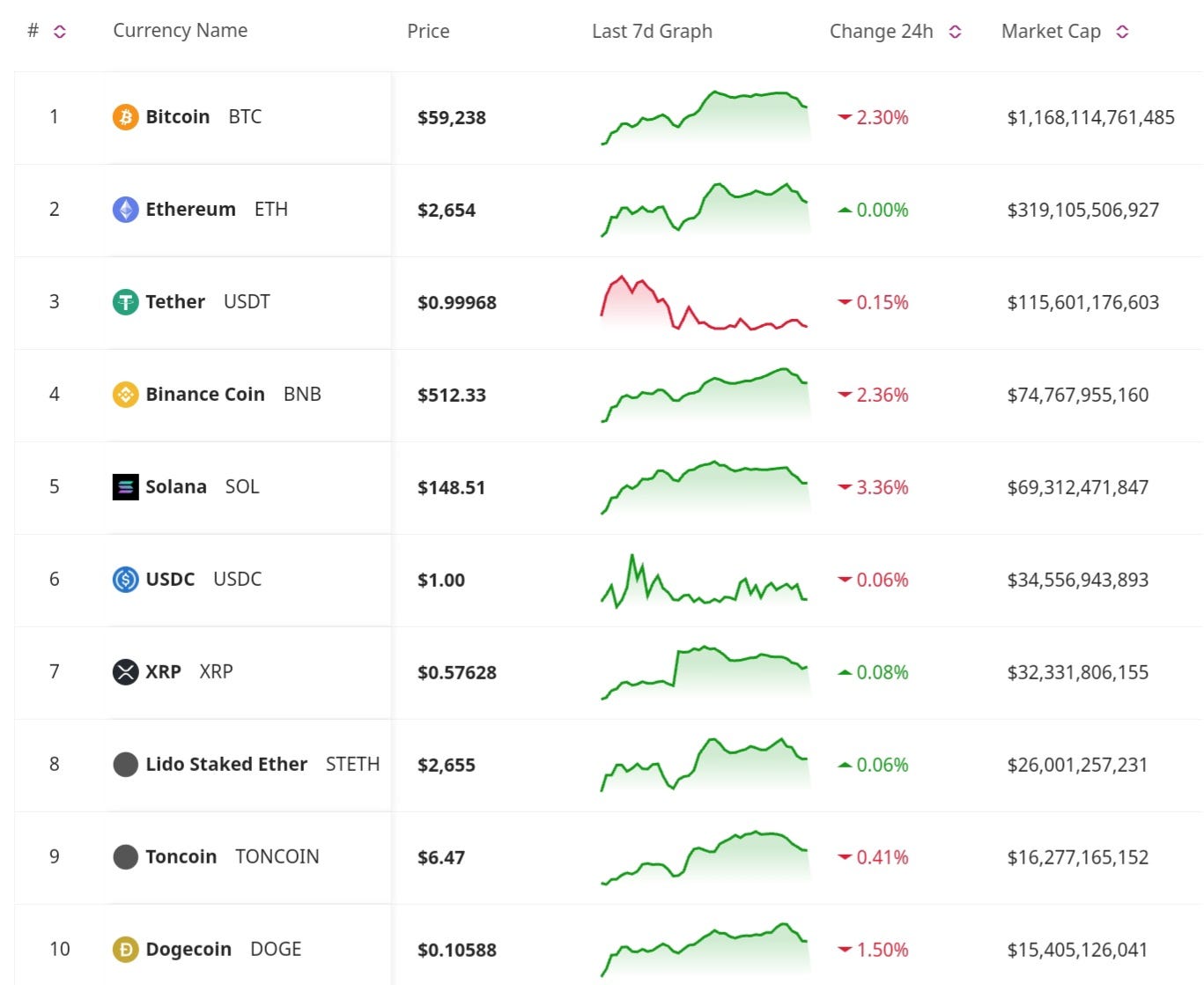

Price Update

Bitcoin Reaching Over $62K and Bulls Eye $100K by Year-End

Bitcoin has grazed the $62,000 mark, reigniting discussions among bullish investors about a potential $100K target by the end of the year. Analysts suggest that if Bitcoin maintains its current momentum, it could achieve new all-time highs before the year’s end. However, the path to $100K is expected to be volatile, with potential market corrections along the way. Currently, the coin went back to $59K.

Crypto ETFs News

U.S. Spot Bitcoin ETFs See $192 Million in Inflows

U.S. spot Bitcoin ETFs have recorded $192 million in inflows, reflecting strong investor demand. The inflows suggest that retail and institutional investors are confident in Bitcoin’s long-term potential. The success of these ETFs is also seen as a positive sign for the broader acceptance and integration of Bitcoin into traditional financial markets.

Hong Kong’s Crypto ETF System Faces Market Obstacles

Hong Kong’s efforts to establish a robust crypto ETF market are facing systemic obstacles, including regulatory challenges and market infrastructure issues. The main challenge is the lack of incentives for brokerages to offer them, since the commission is too low. These obstacles are slowing down the adoption and growth of crypto ETFs in the region. Despite these challenges, Hong Kong remains committed to developing its crypto market, aiming to position itself as a leader in Asia.

SEC Postpones Decision on Hashdex’s Bitcoin and Ether ETF

The SEC has postponed its decision on Hashdex’s proposed ETF that would hold both Bitcoin and Ether. The delay reflects the SEC’s cautious approach to approving new crypto financial products during ongoing regulatory scrutiny. Hashdex’s proposed ETF is part of a broader trend of increasing interest in crypto-based investment products. The market is awaiting the SEC’s final decision, which could have significant implications for the future of crypto ETFs in the U.S.

Launches and Developments

Ripple Begins Testing Stablecoin RLUSD

Ripple has started testing its new stablecoin, RLUSD, on the XRP Ledger and Ethereum networks. The RLUSD stablecoin is designed to facilitate faster and more efficient cross-border transactions, enhancing Ripple’s existing payment solutions. The testing phase will focus on ensuring the stablecoin’s stability, security, and interoperability across different platforms.

Regulatory News

Crypto.com and Gemini Oppose CFTC Proposal on Prediction Markets

Crypto.com and Gemini have joined Coinbase in opposing a CFTC proposal that could ban prediction markets. The exchanges argue that prediction markets provide valuable insights into market sentiment and should be allowed to operate under clear regulatory guidelines. The proposal has sparked a debate over the role of prediction markets in the financial ecosystem and the potential impact of a ban on innovation and market efficiency.

IRS Updates Crypto Brokerage Tax Forms

The IRS has updated its crypto brokerage tax forms, with an apparent removal of the request for wallet addresses. Removing the wallet address request may ease privacy concerns among crypto users while still ensuring compliance with tax obligations. The updated tax forms reflect the IRS’s commitment to adapting its policies to the evolving crypto landscape.

The cryptocurrency market is witnessing significant developments, with Bitcoin’s price surge reigniting bullish sentiments and driving substantial ETF inflows. Ripple’s stablecoin testing and Hong Kong’s crypto ETF challenges highlight the ongoing innovation and regulatory hurdles in the industry. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc