Bitcoin Closer to $100K and FTX Sets Reimbursement Timeline - November 22, 2024

Also, investors prefer BTC to Gold, and Gary Gensler’s exit signals shift.

TL;DR: Crypto Insights in Seconds

Pro-Crypto Agenda: Trump proposes a Bitcoin reserve and hints at major policy shifts.

Ethereum: On-chain volume surge as traders ride the crypto wave.

Gold vs. Bitcoin: Institutional investors continue shifting from gold to BTC.

Solana: SEC is reportedly engaging with applications for Spot ETFs.

SEC: Gary Gensler hints at stepping down before Trump’s administration.

Trump: Files trademark application for a payment platform.

FTX: Sets timeline to reimburse investors.

Mastercard and JPMorgan: Partner up to integrate foreign exchange into blockchain

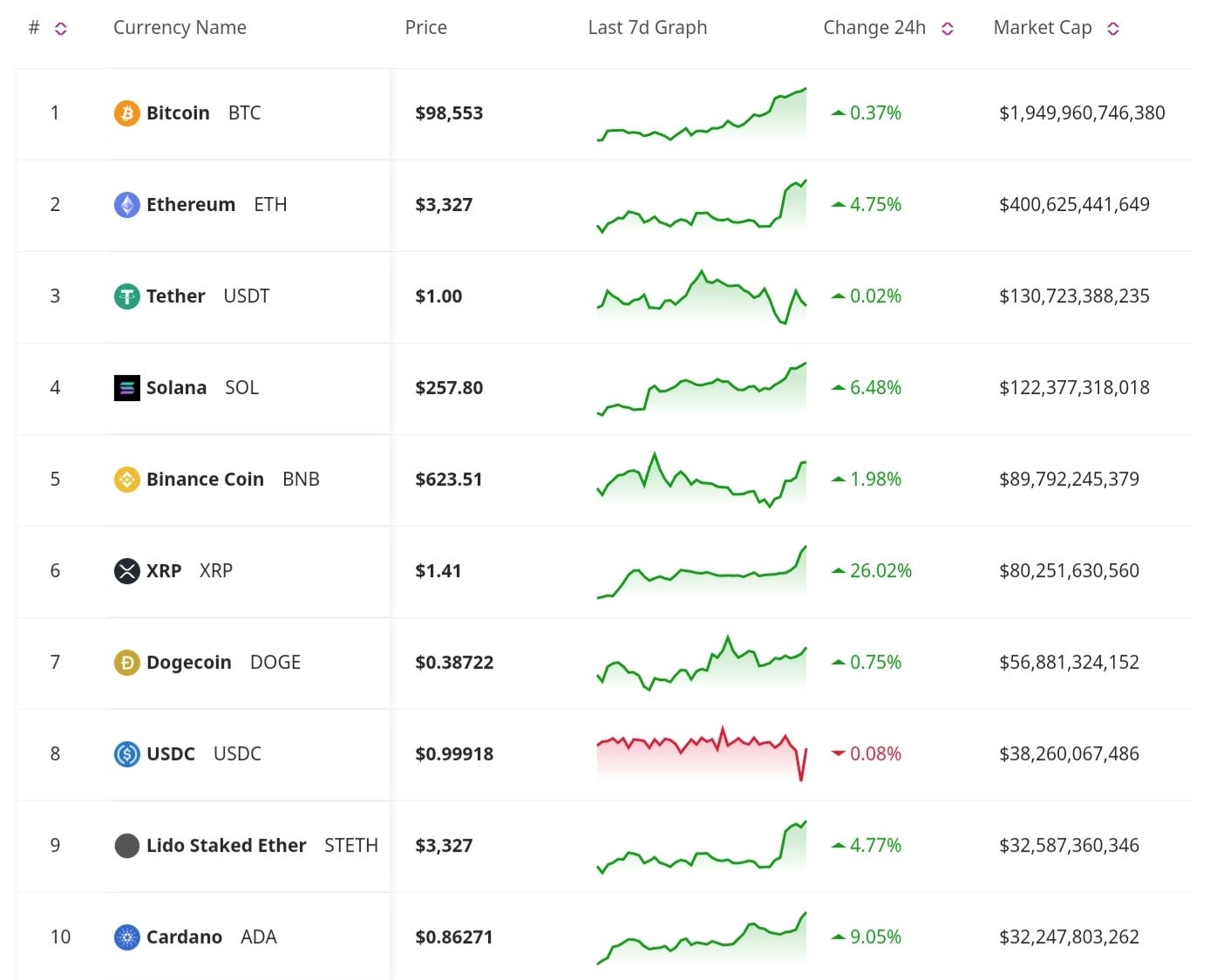

Price Update

Bitcoin Hits New Highs, Reaching $98K

Bitcoin continued its spectacular rally surpassing the $98K mark. Analysts credit inflows into Bitcoin ETFs and growing confidence in pro-crypto regulatory changes under the Trump administration for fueling this momentum. However, warnings of a potential pullback are surfacing as the market approaches significant psychological barriers.

Market Trends

Ethereum and Memecoins on the Rise

Ethereum recorded $7.13 billion in on-chain volume in November, underscoring its role in facilitating the ongoing bull market. Meanwhile, the memecoin index surged as speculative assets gained popularity, buoyed by new token listings that are attracting trader interest.

Institutional Shift From Gold to Bitcoin

Bitcoin’s dominance surged to 57%, as analysts report institutional investors reallocating from gold to BTC. The demand for "digital gold" highlights the ongoing redefinition of safe-haven assets amid global economic shifts.

U.S. Crypto News

Gary Gensler’s SEC Exit Signals Shift

SEC Chair Gary Gensler is reportedly stepping down as Trump positions his administration for a pro-crypto agenda. Industry experts speculate this could lead to accelerated regulatory clarity and innovation-friendly policies, potentially solidifying the U.S. as a global crypto hub.

Trump Files for “TruthFi” Trademark Application

Trump Media & Technology Group filed a trademark for "Truthfi," a digital asset trading and payment platform, alongside plans for wallet software. The filing coincides with reports of advanced talks to acquire Bakkt, a regulated crypto trading platform.

U.S. Government Could Establish Crypto Advisory Council

President-elect Donald Trump’s proposed Crypto Advisory Council may establish a U.S. bitcoin reserve, guide crypto policy, and collaborate with federal agencies, Reuters reports. Key industry figures from firms like Ripple and a16z are vying for council spots, with the council potentially operating under the White House’s National Economic Council.

Spot Solana ETFs Could Come Soon

The SEC is reportedly engaging with applications for spot Solana ETFs, with filings submitted by VanEck, 21Shares, Bitwise, and Canary Capital through the Cboe exchange. Bloomberg analysts suggest SEC decisions could be influenced by political changes and market dynamics, with a potential timeline extending into 2025.

Don’t Miss Anything

FTX Sets Reimbursement Timeline

FTX announced plans to start reimbursing users by March 2025, marking a significant step in its restructuring process. This development comes as creditors and investors alike await clearer signals of recovery from the collapse of one of the largest exchanges.

Mastercard and JPMorgan Blockchain Partnership

Mastercard and JPMorgan have teamed up to integrate foreign exchange into blockchain, a move seen as a step toward broader adoption of digital financial systems. This collaboration highlights traditional finance’s deepening interest in leveraging blockchain.

The crypto market is buzzing with activity, from Bitcoin's relentless climb to new heights to Ethereum’s growing utility and Trump’s bold pro-crypto proposals. With institutional interest intensifying and policymakers showing greater openness to the sector, the stage is set for transformative growth in the digital asset space. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

LFG 🚀