Bitcoin Breaks $66K, XRP Leads Gains, and Binance’s CZ Remains Free - September 30, 2024

A quick and digestible recap of the weekend’s crypto news.

TL;DR: Market Insight in Seconds

Bitcoin: Hits $66K fueled by positive inflation data and high spot ETF inflows.

XRP: Leads weekend gains.

FTX: Creditors begin to recover a portion of their assets from the FTX collapse.

Mango Markets: Settles with SEC and agrees to destroy MNGO tokens as part of the settlement.

Spot ETH ETF: BlackRock’s ETF surpasses $1 billion.

U.S. Spot Bitcoin ETFs: Keeps logging gains and reaches 2-month high.

CZ: Binance CEO Changpeng ‘CZ’ Zhao remains free.

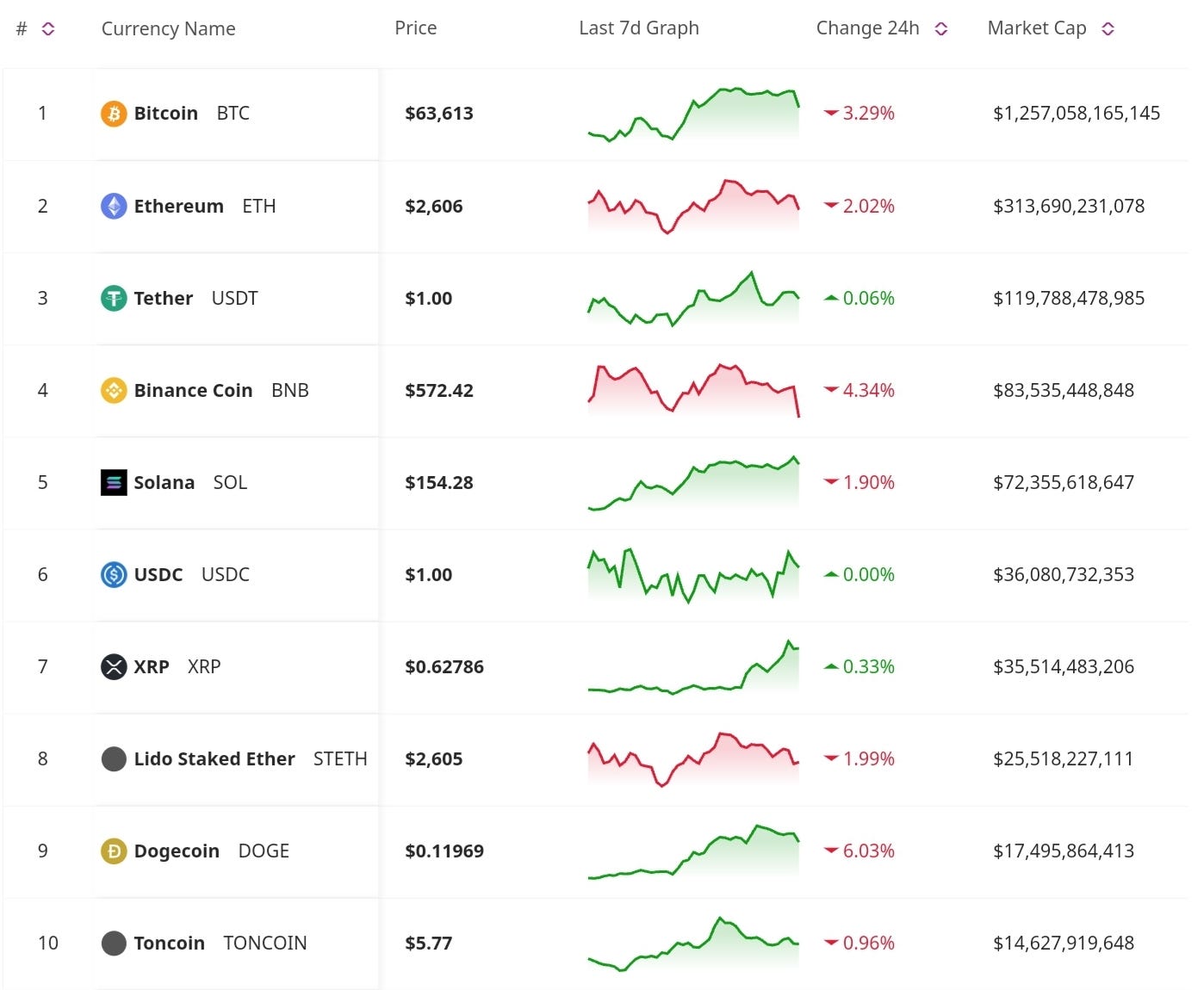

Price Update

Bitcoin Breaks $66K as FOMO Returns

Bitcoin has broken past the $66,000 mark amid positive inflation data and strong inflows into spot Bitcoin ETFs. Analysts have noted that FOMO (fear of missing out) is once again gripping the market. The latest price rally is supported by growing optimism around the U.S. economy and the potential for continued ETF inflows, marking the highest daily inflow since June. Currently, the token hovers the $63K mark.

XRP Leads Weekend Gains with Surging Open Interest

XRP has been leading the charge among altcoins, with substantial weekend gains fueled by a surge in open interest. The cryptocurrency has caught the attention of investors as optimism grows around potential developments in its ongoing legal battles and broader market momentum.

Market Trends

BlackRock’s Spot Ethereum ETF Surpasses $1 Billion in Value

BlackRock’s spot Ethereum ETF has surpassed $1 billion in value for the first time. This achievement shows the increasing demand for regulated Ethereum investment products as institutional players continue to seek safe and compliant exposure to digital assets.

U.S. Spot Bitcoin ETFs See Highest Inflows Since June

Spot Bitcoin ETFs in the U.S. logged their highest single-day inflows since June, signaling a resurgence of institutional interest in Bitcoin. This surge in inflows has helped push the total value of U.S. spot Bitcoin ETFs to a two-month high.

Regulatory Updates

FTX Creditors to Receive 10-15% of Their Crypto Holdings

In a small victory for those affected by the collapse of FTX, creditors are expected to receive 10-15% of their lost assets back. While this represents only a fraction of their initial holdings, the process marks a step forward in the resolution of the FTX bankruptcy case.

Binance CEO Changpeng ‘CZ’ Zhao Remains Free

Binance founder Changpeng ‘CZ’ Zhao has been confirmed as a free man, despite ongoing legal challenges facing Binance globally. The announcement came after recent speculation about his status, reaffirming that CZ continues to operate without being detained.

Mango Markets to Destroy MNGO Tokens in SEC Settlement

Mango Markets has reached a settlement with the SEC, agreeing to destroy its MNGO tokens. This settlement comes after the platform’s collapse and SEC charges, emphasizing the regulatory crackdown on misrepresented digital assets.

Bitcoin’s breakout above $66K and the resurgence of FOMO have injected fresh energy into the crypto market. XRP’s impressive gains and BlackRock’s Ethereum ETF milestone underscore the growing interest and demand for crypto assets. Meanwhile, regulatory issues continue to loom large, with settlements like Mango Markets’ SEC deal and ongoing efforts to resolve FTX's collapse. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.

Take a look at our website for more insights: https://blockconsulting.cc