Bitcoin Blasts Past $76K Post-Election, and BlackRock’s ETF Sees Explosive Volume - November 7, 2024

Also, altcoins see significant gains, but WLFI stays behind.

TL;DR: Crypto Insights in Seconds

Altcoins: UNI and other DeFi tokens surge as market sentiment turns bullish post-election.

BlackRock: BTC ETF hits $1 billion in trades within 20 minutes of market opening.

Memecoins: Election-themend memecoins see increased price gains.

Crypto Stocks: Crypto stocks rise, including Coinbase and BTC mining companies.

WLFI: Trump’s project token stays behind even after winning elections.

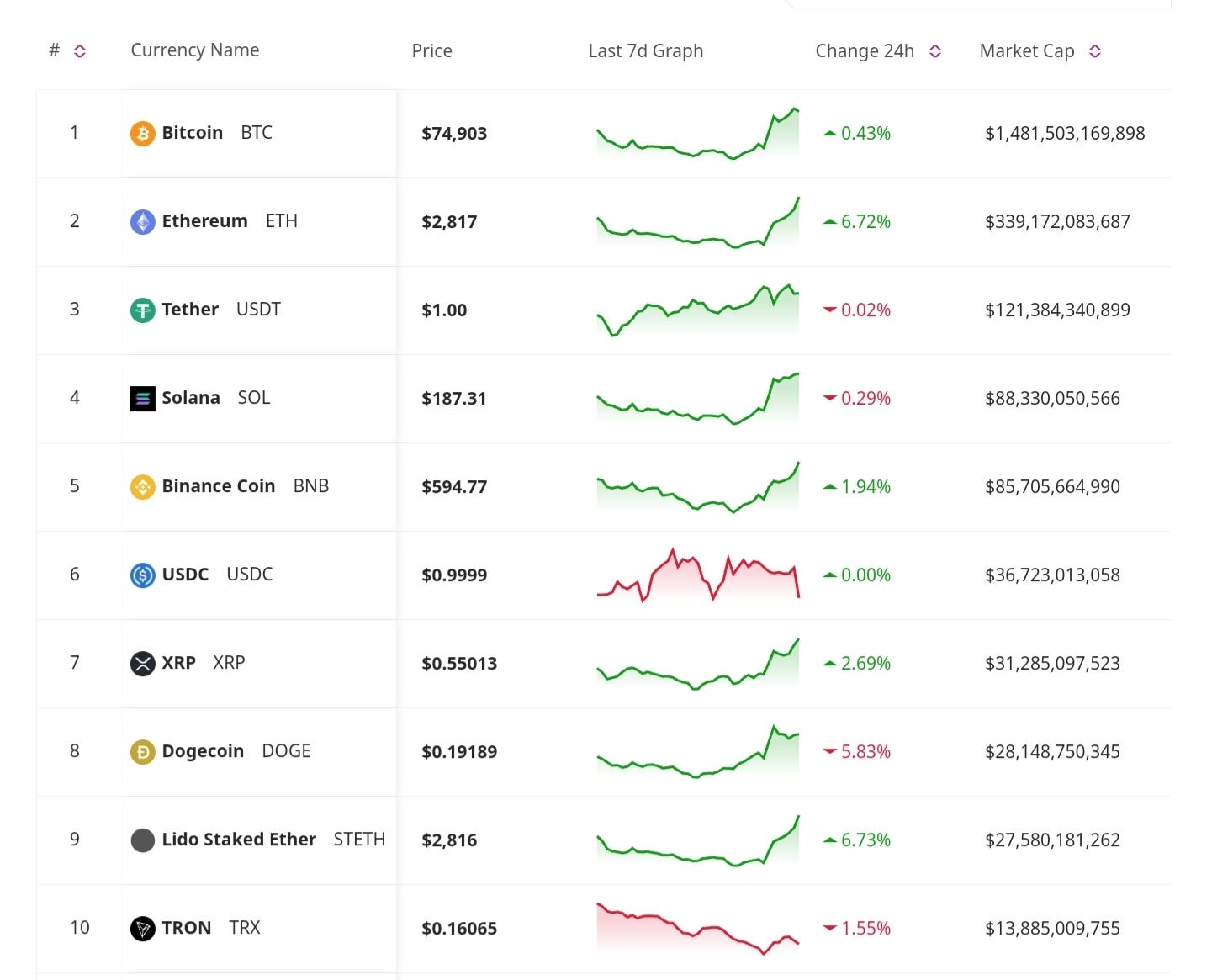

Price Update

Bitcoin Breaks $76K as $400M in Shorts Get Liquidated

Bitcoin’s price jumped past $76,000, marking a new all-time high, as the market witnessed a massive short squeeze that liquidated nearly $400 million in short positions. This sharp price increase is a demonstration of the growing interest in BTC following Trump’s presidential win, which traders see as favorable for the crypto industry.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Post-Election Market

Election-Themed Memecoins Spike in Value

Election-inspired tokens like "Peanut the Squirrel" and the "Department of Government Efficiency" saw substantial price increases as traders jumped into the memecoin frenzy following Trump’s victory. While these tokens are expected to be volatile, their popularity is another tell of how quickly the crypto market reacts to current events.

DeFi Tokens Surge Following Election Results

DeFi tokens, including AAVE and UNI, have experienced significant rallies alongside Bitcoin, with UNI jumping 28% post-election. The market is showing optimism that DeFi projects will benefit from a favorable regulatory environment, with investors looking toward decentralized finance as a viable alternative to traditional financial services.

Business News

BlackRock’s Bitcoin ETF Records $1 Billion in Trading Volume Post-Election

Following the election, BlackRock’s spot Bitcoin ETF witnessed an unprecedented $1 billion in trading volume within 20 minutes of market opening. This strong inflow indicates institutional confidence in Bitcoin, with the ETF allowing more traditional investors to participate in crypto markets.

Coinbase and Crypto Stocks Soar as Trump Win Boosts Market Sentiment

Coinbase’s stock, along with shares in Bitcoin mining companies, rallied on news of Trump’s victory. Coinbase CEO Brian Armstrong reiterated his belief that crypto is “here to stay,” encouraging confidence among retail and institutional investors alike.

WLFI Stays Behind During Market Rally

Bitcoin and other tokens hit new highs following Donald Trump’s 2024 U.S. presidential election victory. However, sales of World Liberty Financial's WLFI token have lagged, with less than $1,500 sold in the past 24 hours. Although the token raised $14.8 million since its October 15 launch, this falls short of its initial $300 million target. WLFI, which limits U.S. retail investor participation, has drawn skepticism from some crypto industry figures who view it as more opportunistic than innovative.

Bitcoin’s sharp rally above $76K highlights the market’s enthusiasm post-election, as traders anticipate favorable regulatory and economic conditions under Trump’s administration. BlackRock’s ETF volume surge and the performance of Coinbase and crypto mining stocks illustrate the positive institutional response to these developments. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.