Altcoins Liquidations, and BTC Jumping Back to $96K - January 14, 2025

Also, Tether HQ is moving to El Salvador, and FTX to pay $1.2 billion to creditors.

TL;DR: Crypto Insights in Seconds

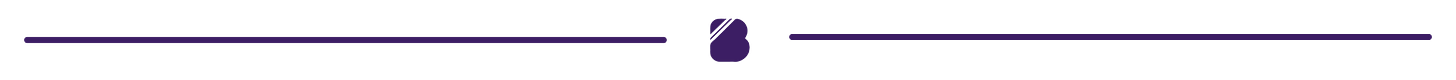

BTC: Falls below $90K and jumps back to $96K.

Altcoins: In just 24hs the market saw $328 million in long and $66 million in short liquidations.

Crypto: CoinShares reports a downturn in crypto fund flows, ending the honeymoon after elections.

UK: Collaborates with NYDFS to develop a framework for digital assets.

Tether: After securing license in El Salvador, is moving the HQ to the country.

FTX: Soon will distribute $1.2 billion to creditors.

SEC: A U.S. court ordered the SEC to clarify refusal to clarify crypto rules.

BlackRock: Introduces BTC ETF in Canada.

MicroStrategy: Takes advantage of the dip and buys BTC. Now it holds 450,000 BTC.

Price Update

Bitcoin Falls Below $90K Due To Economic Fears

Yesterday, Bitcoin's price dipped under $90,000 as investors brace for potential economic turbulence. Analysts suggest this is part of a broader post-holiday market trend, with macroeconomic concerns adding pressure. Historical patterns post-halving years also indicate similar early-year slumps, so they keep an optimistic outlook long term.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Market Trends

Altcoins Struggle Amid Long Liquidations

The crypto market witnessed a surge in long liquidations, particularly impacting altcoins. This follows widespread market corrections as traders recalibrate their positions post-election.

Crypto Fund Flows Reverse After U.S. Elections

The honeymoon period following the U.S. elections appears to have ended, with CoinShares reporting a downturn in crypto fund flows. This shift recommends caution among institutional investors during macroeconomic uncertainties.

Legal and Regulatory Updates

UK Digital Asset Push Gets Support from NYDFS

The New York Department of Financial Services (NYDFS) is collaborating with the Bank of England to develop frameworks for digital assets. This partnership is another demonstration of the growing global interest in creating secure and scalable systems for digital currencies.

Tether Secures License in El Salvador

Tether has received a local license to operate in El Salvador and it is moving its HQ to the country, further strengthening its presence in the country. The license allows Tether to tokenize real estate and other properties.

FTX to Return $1.2 Billion After Inauguration

FTX has announced plans to distribute $1.2 billion to creditors, coinciding with Trump’s upcoming inauguration. The settlement marks a critical step in resolving the fallout from one of crypto's biggest collapses.

SEC Faces Court Scrutiny Over Coinbase Rules

A U.S. court has demanded the SEC clarify its refusal to issue crypto-specific rules following Coinbase’s legal challenge. The ruling adds to mounting pressure on the SEC to create tailored regulations for digital assets.

Business News

BlackRock Introduces Bitcoin ETF in Canada

BlackRock, a major player in asset management, has launched a Bitcoin ETF in Canada, bypassing regulatory hurdles in the U.S. This decision is to tap into the Canadian market's growing demand for crypto investment products.

MicroStrategy Holds Tight Amid Bitcoin Dip

Despite the market's downturn, MicroStrategy has reaffirmed its bullish stance on Bitcoin. The firm now holds over 450,000 BTC, underscoring its strategy to capitalize on price corrections as buying opportunities.

The crypto market faces significant headwinds as we enter 2025. From Bitcoin's dip to regulatory and institutional shifts, traders and investors are navigating a complex environment. However, strategic moves by firms like BlackRock and MicroStrategy underscore enduring optimism for long-term growth. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.