AI Tokens 90% Down, and Could BTC Reach $120K Soon? - February 7, 2025

Also, Latin America embraces crypto, and ETH sentiment turns bearish.

TL;DR: Crypto Insights in Seconds

BTC: Data suggest that BTC could reach $120K in Q1, but analysts warn about excessive leverage.

AI: Many tokens crash around 90% as investors consider long-term profitability.

Latin America: Reports show that many countries and companies are increasing their BTC holdings.

ETH: Sentiment turns bearish, which is affecting the price.

U.S. Regulation: Lawmakers debate about crypto debanking and about the fairness of the practice.

Czech: Exempts long-term crypto gains from taxes.

Berachain: Announces $632 million in airdrops ahead of mainnet launch.

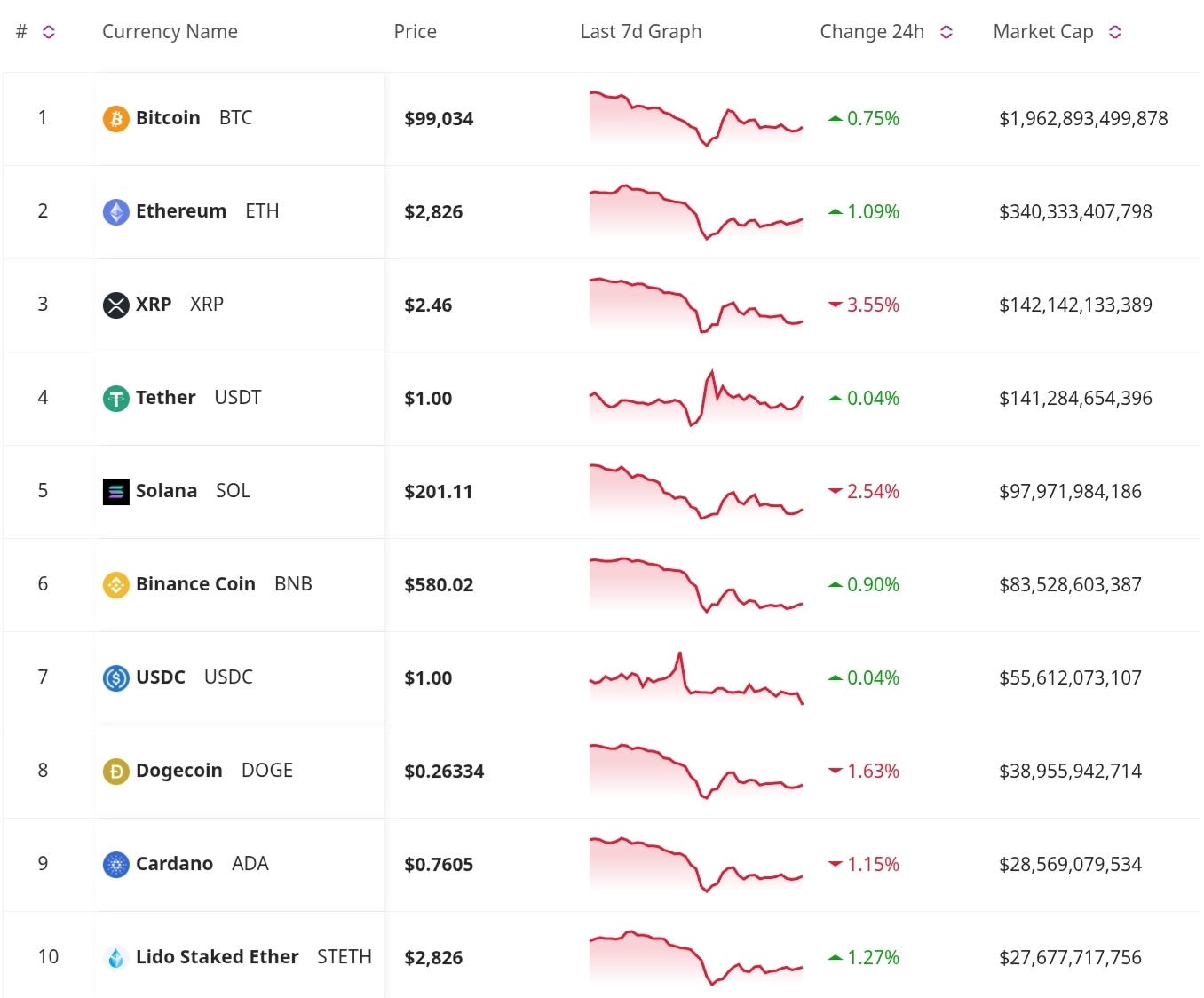

Price Update

Bitcoin Seasonality Suggests $120K Target, but Leverage Poses a Risk

Historical data suggests Bitcoin could reach $120,000 in Q1, following seasonal trends. So far, the token has remained above $90K, which is a good sign that could indicate further growth. However, analysts warn that excessive leverage in the market remains a major risk factor, potentially leading to volatility and liquidations.

AI Tokens Crash 90% from All-Time Highs

AI-related cryptocurrencies have seen massive declines, with many tokens losing up to 90% of their peak value. Tokens like ARC, AI16Z, and VIRTUAL have lost between 70% and 90%. The rally has cooled as investors reevaluate the long-term viability of AI projects in the crypto space, especially with the current volatility in the tech sector across all markets.

This edition is brought to you by RentFi, the innovative platform that provides monthly passive income from high-yield real estate properties worldwide. Say goodbye to paperwork, minimum investments, and property management headaches. Start earning today!

Market Trends

Latin America Embraces Bitcoin Reserves

Several Latin American countries and corporations are reportedly increasing their Bitcoin holdings, mirroring the US's growing strategic interest in BTC as a reserve asset. Brazil and Argentina are leading the movement, deregulating and facilitating crypto transactions. Also, big companies like Mercado Libre are introducing stablecoins in Brazil.

Ethereum Sentiment Turns 'Unbelievably Bearish,' Says Galaxy’s Novogratz

Galaxy Digital’s Mike Novogratz has noted a sharp decline in Ethereum sentiment, with the ETH price struggling. He attributes this bearish outlook to slow network upgrades, regulatory concerns, and shifting investor interest.

Regulatory Updates

U.S. Lawmakers Debate About Crypto Debanking and Its Impact

A U.S. House subcommittee hearing highlighted growing concerns over "crypto debanking," where banks are closing accounts tied to the crypto industry. Some argued that banks are overreacting due to regulatory pressure, while others pointed to crypto’s history of fraud and volatility. The issue has sparked tension between policymakers advocating for financial inclusion and those prioritizing financial stability.

Czech Republic Exempts Long-Term Crypto Gains from Taxes

The Czech president has signed a new law exempting crypto gains from capital gains tax if held for more than three years. This decision is expected to attract long-term crypto investors and promote broader adoption.

Don’t Miss Anything

Berachain Announces $632 Million Airdrop Ahead of Mainnet Launch

Berachain is distributing $632 million worth of BERA tokens as part of its airdrop, fueling excitement ahead of its mainnet debut. With the airdrop, it is expected to grow user engagement and network expansion.

Due to regulatory challenges and macroeconomic factors, the market is facing considerable uncertainty. Traders are anticipating new developments, while investors are re-evaluating their holdings and entries. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.