1.28B Market Liquidations, and Trump Memecoin Drama - January 21, 2025

Also, changes for the SEC and the CFTC, and WLF buys ETH.

TL;DR: Crypto Insights in Seconds

BTC: Flirts with ATH of $109K before dropping.

Melania: Melania Trump’s token has drawn speculation, some accusing it of a rug pull.

Trump: Inauguration speech didn’t mention crypto and the market fell, causing $1.28B liquidations.

WLF: Bought $90 million in tokens like ETH, WBTC, and more.

SEC and CFTC: See new crypto-friendly leadership.

Bernstein: Analysts consider Trump coin could be a shift in paradigm.

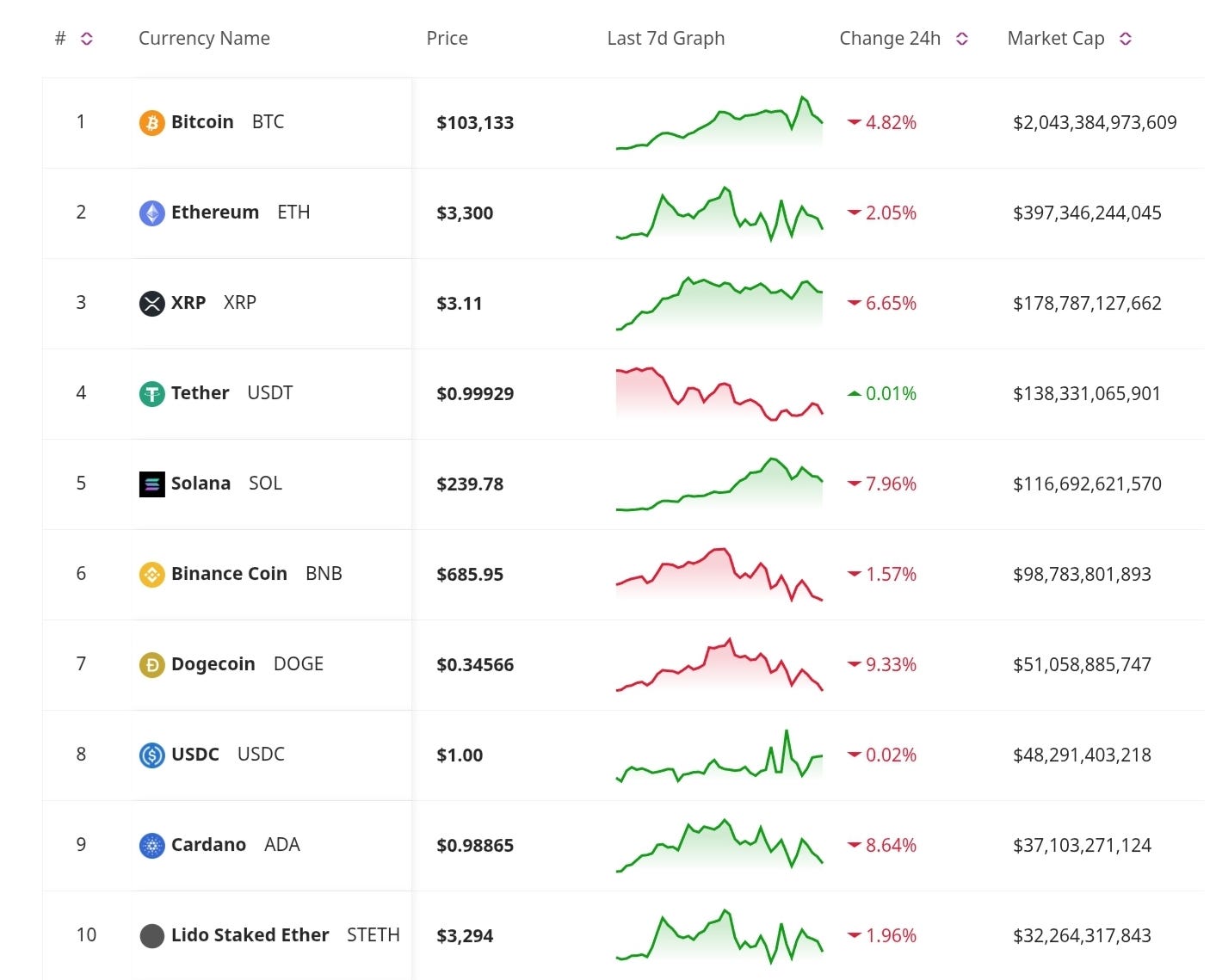

Price Update

Bitcoin Nears All-Time High Before Drop

Bitcoin briefly flirted with a record price of $109,000, encouraged by optimism ahead of Trump’s inauguration. However, market volatility began following the speech’s lack of direct crypto mentions, leading analysts to predict continued fluctuations in the short term.

Token Deal—Bid and Win Crypto!

With Token Deal, every bid brings you closer to winning crypto prizes like 1 BTC. No rising prices, no extra costs—just excitement. Place your Bids and be the last bidder to win! Plus, earn free Bids daily by participating. Start now!

Trump’s Memecoin Saga

Melania’s Memecoin Under Fire

Following the launch of Melania Trump’s memecoin, concerns over potential rug pulls have emerged. The memecoin’s market volatility has drawn criticism from Washington insiders and crypto leaders who argue it detracts from blockchain’s long-term potential. The community is strongly criticism the project and it lost around 80% value since its launch.

Trump’s Inauguration Speech Don’t Mention Crypto and Markets React

Despite high expectations, President Donald Trump made no mention of Bitcoin or cryptocurrency in his inauguration speech, focusing instead on broader economic innovation. The omission caused ripples in the crypto market, with liquidations surging to $1.28 billion as Bitcoin briefly flirted with a record high of $109,000 before retreating.

World Liberty Financial Diversifies Holdings

Trump-backed project, World Liberty Financial, has swapped $90 million worth of stablecoins for Ethereum (ETH), Wrapped Bitcoin (WBTC), and other tokens. This strategic diversification has drawn speculations, some analyst saying it is to help mitigate market volatility, and other claiming a strategic movement posed for future gains.

Regulatory and Legal News

SEC and CFTC: Mark Uyeda and Caroline Pham Take Key Roles

Trump has named SEC Commissioner Mark Uyeda as Acting Chair, indicating potential crypto-friendly changes in regulatory oversight. Additionally, Caroline Pham, a CFTC Commissioner known for her progressive views on digital assets, has been tapped to lead the CFTC. These appointments suggest a possible shift in the U.S. regulatory landscape toward supporting crypto innovation.

Don’t Miss Anything

Bernstein Analysts Says Trump Is A Paradigm Shift

Bernstein analysts called TRUMP a “paradigm shift,” even though some might cringe. The token could potentially pave the way for favorable U.S. crypto policies. Critics, however, like Anthony Scaramucci, labeled it harmful to the industry, citing concerns over corruption. While the token reflects regulatory openness, reactions are divided on its impact on the broader crypto ecosystem.

While Trump’s lack of crypto focus during his inauguration speech caused short-term volatility, key regulatory appointments and strategic moves by major players signal long-term potential. The memecoin craze and Bitcoin’s resilience underline the market's evolving dynamics, as both hype and innovation drive the narrative. As the market evolves, being informed and adaptable is crucial for investors and participants. Stay tuned for tomorrow’s newsletter to get the latest insights and updates in the market.